Mortgage calculator with extra payments starting later

It will not affect the calculation. Understanding the breakdown of your mortgage payments is a useful way to manage your debt and plan for your financial goals.

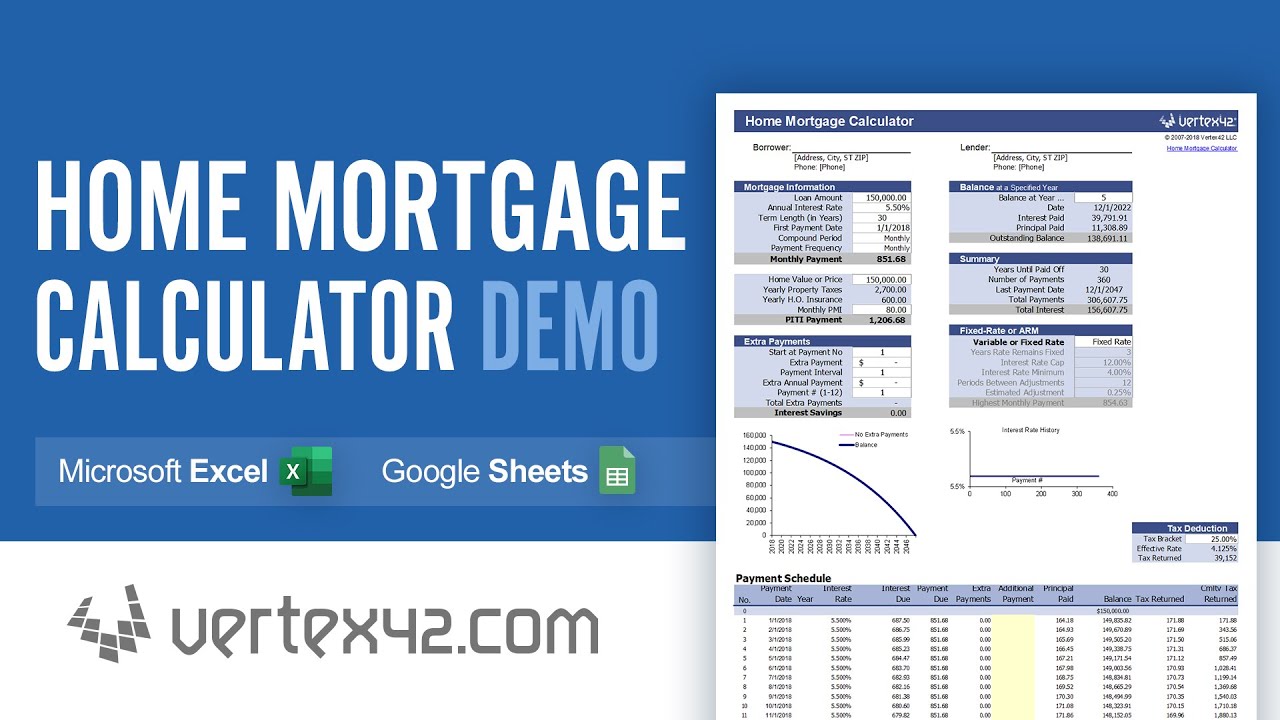

Home Mortgage Calculator Demo Youtube

Find out how we can support you to get back on track with your payments.

. The most common loan terms are 15 and 30 years though there are other terms available. Accessibility statement Accesskey 0. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan.

Today Eustis Mortgage Corporation remains committed to these same principles. An amortization schedule helps you better track and plan out your mortgage payments. Select Jan 2014 for when youll make the extra payment.

Now press the View Amortization Schedule button. 1 To qualify certain conditions must be met. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. Any regular monthly overpayments remain the same over the term of the mortgage. To qualify for a monthly account fee waiver on a new Preferred or Ultimate Package for up to 1 year the Offer you must.

So if the balance at the beginning of the month is less than the monthly payment amount B6 then make 0 extra repayment otherwise use the extra repayment amount as we set up in B11. Interest rates can be high and a missing a payment can mean debts start to increase. Using our mortgage rate calculator with PMI taxes and insurance.

Explore and compare our mortgage rates and apply online with Lloyds Bank. Some mortgage prisoners are starting to escape to much cheaper deals and one of the first homeowners to. Your home value has increased considerably.

Their vision was to provide exceptional loan services to clients by maintaining a low staff turnover rate. Do not want to borrow more. When to consider a refinance of your reverse mortgage.

First and foremost your listing price should be based on the amount you owe on your reverse mortgage balance as given in your due and payable letter. Leave the ending date as is. Just make sure the year is later than the extra payment year.

The calculation works by dividing the total cost of your monthly debts by your gross monthly income. Eustis Mortgage Corporation was founded in 1956 in New Orleans LA by two determined and dedicated loan officers. So you can work this out for yourself.

The AAG Advantage Jumbo Reverse Mortgage. Support to help with rent or mortgage payments if youre on a low income. Later on when compound interest has grown your wealth you could make extra payments toward your home loan principal to build more equity.

Set a listing price. Find out more about mortgages. Support for mortgage customers.

Borrowers have the option of paying for mortgage points at closing to get a lower mortgage rate. All years are of equal length. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments.

Benefits in later life You may be entitled for. Once you feel your retirement portfolio is in good shape. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low.

Your mortgage term impacts your monthly payments. Open a new or transfer an existing Eligible Mortgage as defined below which is approved and funded between April 1 2022 and September 30 2022. Based on a repayment mortgage.

Credit cards or store cards. Use our MoneyHelper mortgage affordability calculator to find out how much you can afford to borrow for your new house. On a 150000 25-year mortgage offsetting 25000 of savings could mean you pay off your mortgage one year and 10 months early and save 3350 in interest while still having access to your savings if needed.

Common monthly debt payments include the likes of. You will owe the total debt of the reverse mortgage upon selling or 95 of the appraised value if the debt exceeds the value. Mortgage term refers to the length of time you have to pay back the amount youve borrowed.

Interest is calculated daily and added monthly. Buying down the rate can help reduce your monthly mortgage payments and our mortgage points calculator will give you an idea of how paying points will impact your interest rate and mortgage payments going forward. The extra 5 is covered by insurance.

You can add multiple cards and as part of the result you can alter the repayment amount to see how that affects the length of time youll be paying and how much. The mortgage balance shown on the graph and table are the same and are the amount left on the mortgage at the end of that particular year. If you buy a 200000 house with a 15-year fixed-rate mortgage.

With our extra payments calculator you can also project the potential savings from making additional payments on your home mortgage. No missed mortgage payments over the past six months and no more than one missed payment in the past 12 months Credit score of 620 or higher Loan-to-value ratio of 97 or less. What may happen to your mortgage repayments.

2 No monthly account fees for a year offer conditions. In addition to making extra payments another great way to save money is to lock-in historically low interest rates. The key caveat is that it has to be a like-for-like mortgage in other words no extra borrowing and on the same property.

If youd like to know how to estimate compound interest see the article. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Rent or existing mortgage payments.

The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

Youll see that your mortgage will be paid in just 263 months instead of 288 months. Up to date with your mortgage payments and have been for at least 12 months. Finally we will add a similar if statement to the extra repayment starting at row 2 as follows and fill down as before.

Our calculator will let you see how much a credit card will cost you or how quickly you can pay off your existing cards. Dont misread this as saying.

Biweekly Mortgage Calculator How Much Will You Save

Loan Calculator With Extra Payments Mycalculators Com

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Monthly To Biweekly Loan Payment Calculator With Extra Payments Mortgage Repayment Calculator Loan Payment

Are Extra Mortgage Payments Worth It A Look At The Numbers Mortgage Payment Mortgage Frugal Tips

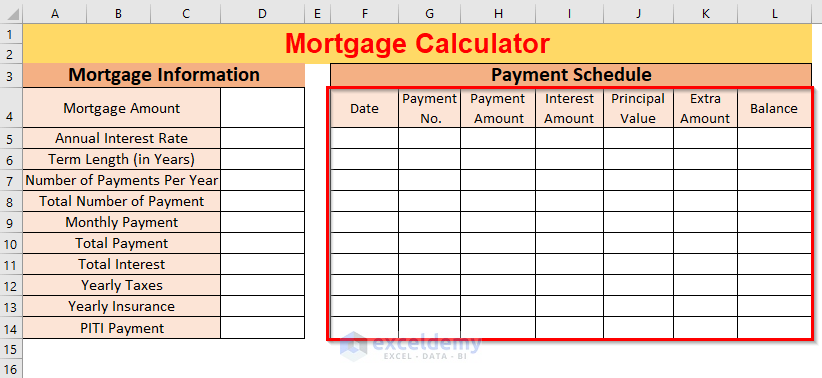

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Calculator With Down Payment Dates And Points

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Mortgage Amortization Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel