401k contribution tax deduction calculator

Your principal grows tax-free. Your average tax rate is 1198 and your marginal tax rate is 22.

Can You Get A Tax Deduction For Your 401 K Smartasset

And remember to claim the Solo 401k deductions on your tax return.

. Click the Customize button above to learn more. A catch-up contribution of for if you are 50 or older. If you make 70000 a year living in the region of Ohio USA you will be taxed 10957.

Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. The amount of contribution for himself to the plan.

The same annual contribution limits of 19500 or 26000 for. Deduction for medical expenses that exceed 75 of AGI. The deadline to make a Traditional IRA contribution for the current tax year is typically April 15 of the following tax year.

Your principal may be subject to taxes on dividends and capital gains as it grows. Or you can also do after-tax Roth Solo 401k contributions. Use the rate table or worksheets in Chapter 5 of IRS Publication 560 Retirement Plans for Small Business for figuring your allowable contribution rate and tax deduction for your 401k plan contributions.

Earning less than 40400 a year as a single taxpayer in 2021. You get a tax deduction essentially letting you deposit pre-tax dollars. Your average tax rate is 1198 and your marginal tax rate is 22.

In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. SmartAssets Utah paycheck calculator shows your hourly and salary income after federal state and local taxes. In this case your net earnings from self-employment is defined as your businesss profit minus the deduction for one half of your self-employment tax.

6000 for 2021 and 6000 for 2022 if youre under age 50. If you see an item with an original price of 2499 and the discount is 175 percent you can plug all of those numbers into our calculator and easily find out that the new price is 2062 with a discount of 437. Follow this link for the information you need about contribution limits for the tax year 2021.

To determine the amount of his plan contribution Joe must use the reduced plan contribution rate considering the plan contribution rate of 10 of 90909 from the rate table in Pub. For example consider a 55 year old with a 100000 pre-tax salary who contributes the maximum annual limit to their 401k in 2022 plus 2000 in catch-up contributions. Homes purchased after Dec.

Utah has a very simple income tax system with just a single flat rate. 15 2017 have this lowered to the first 750000 of the mortgage. This marginal tax rate means that your.

Or you can do a combination of both all within the same Solo 401k plan. Or 403b retirement account you could choose to. If youre eligible you make contributions from your paycheck on a pre-tax basis and your money grows tax-free until you make withdrawals in retirement.

High contribution limits can mean big changes for your financial future. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state. Your 401k plan account might be your best tool for creating a secure retirement.

Regularly-Taxed Account 401k You pay income tax and then make your contribution with post-tax dollars. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Status is important because taxes are calculated differently depending upon whether an employee is single or married.

Some 403b plans allow Roth accounts. If you make 70000 a year living in the region of Oregon USA you will be taxed 15088. Plus many employers provide matching contributions.

The tire diameter calculator exactly as you see it above is 100 free for you to use. This marginal tax rate means that. Solo 401k contributions are tax deductible.

Withdrawing an amount less than what is allowable as a medical expense deduction. This marginal tax rate means that. After all of the numbers are entered into the calculator the person then needs to select whether he or she is a single person or a married individual.

One-half of your self-employment tax and. You can do tax deductible traditional Solo 401k contributions to help lower your taxable income. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Qualified withdrawals are tax-free.

You may even be able to claim your Koinly plan as a tax preparation fee deduction - provided youre self-employed and not a W2 employee. This marginal tax rate means that your. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

Click the Customize button above to learn more. 7000 for 2021 and 7000 for 2022 if youre age 50 or older. The IRC Section 164f deduction which in this case is ½ of his SE tax 14130 x ½.

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. Get it while you still can. Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million.

Your average tax rate is 1198 and your marginal tax rate is 22. Deduction for mortgage interest paid. Common tax deductions include the child tax credit medical expenses deduction and 401k contributions deduction.

Deduction for charitable contributions. See also Calculating Your Own Retirement Plan Contribution. Know the CGT allowance.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. The maximum total annual contribution for all your IRAs Traditional and Roth combined is. The salary calculator exactly as you see it above is 100 free for you to use.

An employee contribution of for An employer contribution of 20 of your net earnings from self-employment and. Your average tax rate is 1198 and your marginal tax rate is 22. Dont miss out on this chance to claim that contribution and pay less in taxes.

You only pay taxes on contributions and earnings when the money is withdrawn. Our calculator even works with fractions of percentages. If you make 70000 a year living in the region of Illinois USA you will be taxed 11737.

Since catch-up contributions are extra savings on top of regular contributions you can get an even bigger tax deduction in the current year. Find the Correct Tax Filing Status in the Drop-Down Box.

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

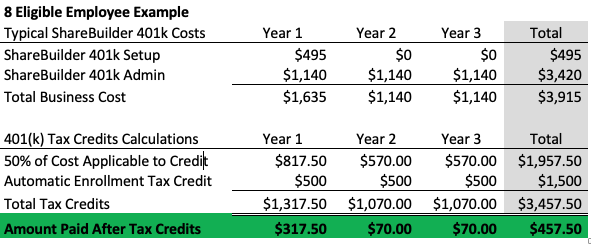

The Secure Act Allows For Up To 16 500 In Tax Credits For Small Business 401 K Plans Sharebuilder 401k

After Tax Contributions 2021 Blakely Walters

After Tax 401 K Contributions Retirement Benefits Fidelity

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Is Tax Loss Harvesting Worth It Tax Loss Worth

Solo 401k Contribution Limits And Types

After Tax 401 K Contributions Retirement Benefits Fidelity

Solo 401k Contribution Limits And Types

Taxable Vs Tax Deferred Investment Calculator Witty One Liners Funny Really Funny

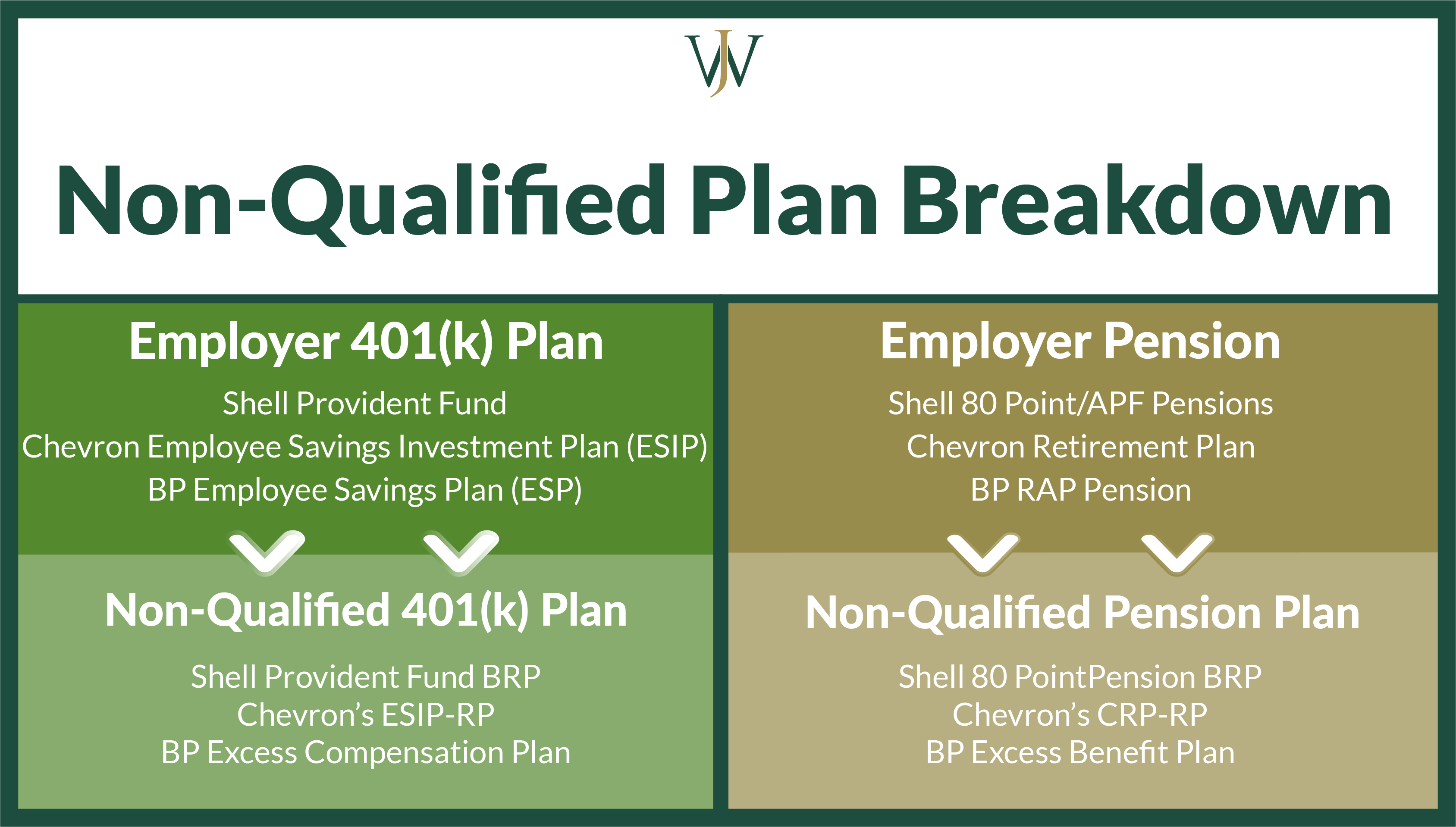

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time